Re-opening for Georgia businesses that have been closed during the pandemic or have provided only limited service will be a process. That is, businesses generally cannot just throw open their doors and resume pre-pandemic business as usual. In addition to the sanitizing, distancing and other health protections and concerns, employers are concerned about bringing employees back to work – especially in light of the increased unemployment insurance (“UI”) benefits to which they are entitled under the CARES Act and concern over loss of the same if employees return to work.

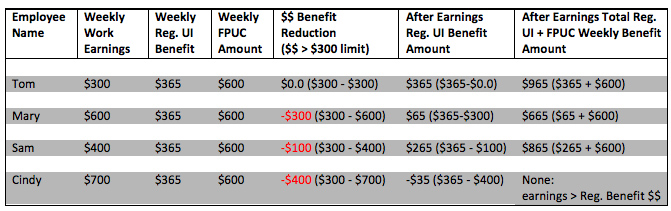

Georgia regular UI provides for what is referred to as “partial benefits” when employees are laid off but are expected to be hired back or when an employee’s hours are reduced. Under regular Georgia UI benefits, an employee can receive anywhere from $55 to $365 a week, depending on the income lost. Under the CARES Act, the federal government allocated another $600 (referred to as the Federal Pandemic Unemployment Compensation or “FPUC”) to each person collecting unemployment insurance benefits so long as that person is entitled to at least $1.00 of regular unemployment insurance benefits. Consequently, employees on Georgia regular UI benefits are currently also entitled to the FPUC. Thus, for example, an employee receiving the greatest benefit under the Georgia regular UI weekly benefit of $365 plus the $600 weekly FPUC is now entitled to a total of $965 a week in UI benefits.

How Georgia regular UI benefits are calculated is a subject better addressed in a separate post. The subject of this post, however, is what happens to the UI benefits that an employee is now receiving if an employer brings that employee back to work?

In that regard, the State quickly realized that the re-opening of businesses would be a process and that the number of employees needed and the hours for each would not likely reach those needed in pre-pandemic times. As a result, the State issued a rule allowing employees who come back to work to earn more than previously allowed and still collect UI benefits.

Specifically, the rule allows employees to earn up to $300 a week and yet KEEP receiving the total UI benefits that they have been receiving. In this way, employees are not penalized (at least up to the $300 per week) for returning to work and employers can better plan on how to bring back employees so as to provide the best combination of work earnings and UI benefits.

Prior to the pandemic and the most recent rule, the most that an employee receiving UI benefits could earn without a reduction in his or her UI benefit amount was $50.00. Once the employee received earnings of $50 a week, the UI benefits were reduced dollar for dollar by the amount earned over $50.00. Now, likely through July 2020, no reduction in UI benefits will occur until the employee has earned $300 a week.

The calculation is somewhat complicated though. In talking with some employers, it was suggested that some examples may be helpful for employer planning. The table below attempts to provide a few examples as we understand the calculation of UI benefits when an employee is also working. For purposes of these examples, the table assumes that the employee is receiving the maximum Georgia regular UI benefit amount of $365 a week.

Although it can be confusing, when each employer decides the time is right, hopefully this information will help employers decide how best to bring employees back.

Article by Lisa F. Harper.

Download this article here.